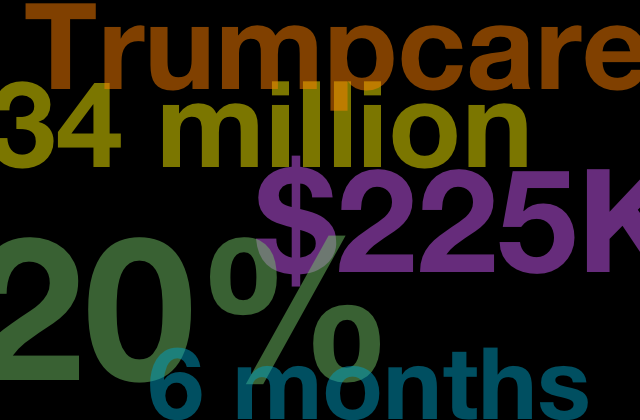

Trumpcare By The Numbers

The nonpartisan Congressional Budget Office released its analysis of the Senate Republican-produced Better Care Reconciliation Act. Here are the most important things to know about the bill that could become the law of the land.

22 million

The total number of Americans who will lose their health insurance between now and 2026 if this plan is signed into law [Congressional Budget Office]

15 million

The number of people who will lose their insurance in 2018 alone [Congressional Budget Office]

$772 billion

The amount of funding that will be cut from Medicaid between now and 2026 [Congressional Budget Office]

34 million

The number of non-elderly people of color who depend on Medicaid for their health care [Henry J. Kaiser Family Foundation]

15 million

The number of people who will lose their Medicaid coverage between now and 2026 [Congressional Budget Office]

6 months

How long people will be locked out of health insurance if they let their coverage lapse for 63+ days, per a provision added after the CBO analysis [The New York Times]

20%

How much premiums for single individuals will increase in 2018 compared to today’s premiums [Congressional Budget Office]

20%

How much premiums for single individuals will decrease by 2026 compared to today’s premiums, due to the proliferation of plans that cover less and have higher deductibles [Congressional Budget Office]

$225 million

The amount of funding that will be withheld from Planned Parenthood during the bill’s one-year block of federal reimbursements for care [Congressional Budget Office]

2.4 million

The number of people who use Planned Parenthood’s services each year [Planned Parenthood]

15%

The percentage of Planned Parenthood patients who will completely lose access to comprehensive reproductive health care [Congressional Budget Office]

$180

The average annual tax cut the lowest 20 percent income-earning households will receive in 2026, representing a bump of 1 percent of their after-tax income [Tax Policy Center]

$250,000

The average annual tax cut the top 0.1 percent income-earning households will receive in 2026, representing a bump of 2.5 percent of their after-tax income [Tax Policy Center]